AI ASSISTANT

Desktop | Mobile Application

Desktop | Mobile Application

Lead UX Designer

TIAA Assistant – an R&D-driven intelligent assistant for mobile banking

UX Designer (self), 1 Product Manager, 1 Front-End Developer (self), 3 Back-end Engineers, 1 Senior Executive Stakeholder

iOS, Android, and Web

As the Lead UX Designer, I was tasked with designing a new R&D-driven feature for TIAA Bank: an AI-powered assistant integrated into their mobile banking app. The goal was to explore innovative ways to serve customer needs around fraud prevention, account servicing, and financial education. This feature aimed to reduce call center volume, increase chatbot adoption, and build trust through a more intuitive and human-centered experience.

Despite initial interest in intelligent assistants, early prototypes lacked engagement due to:

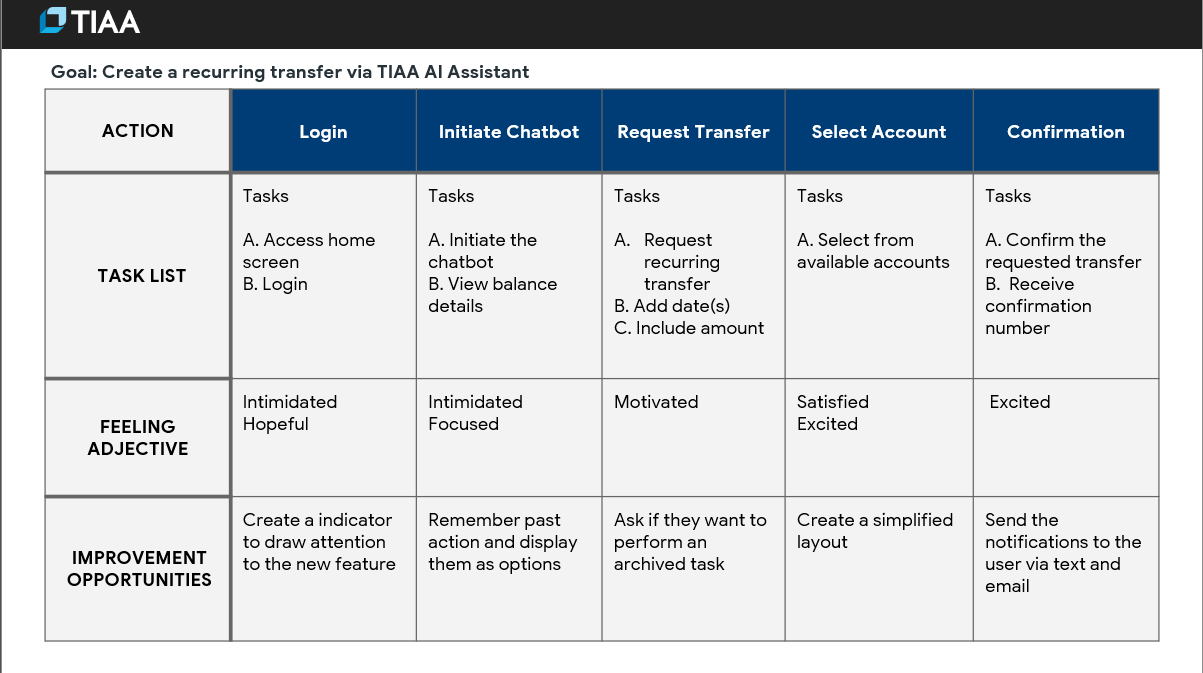

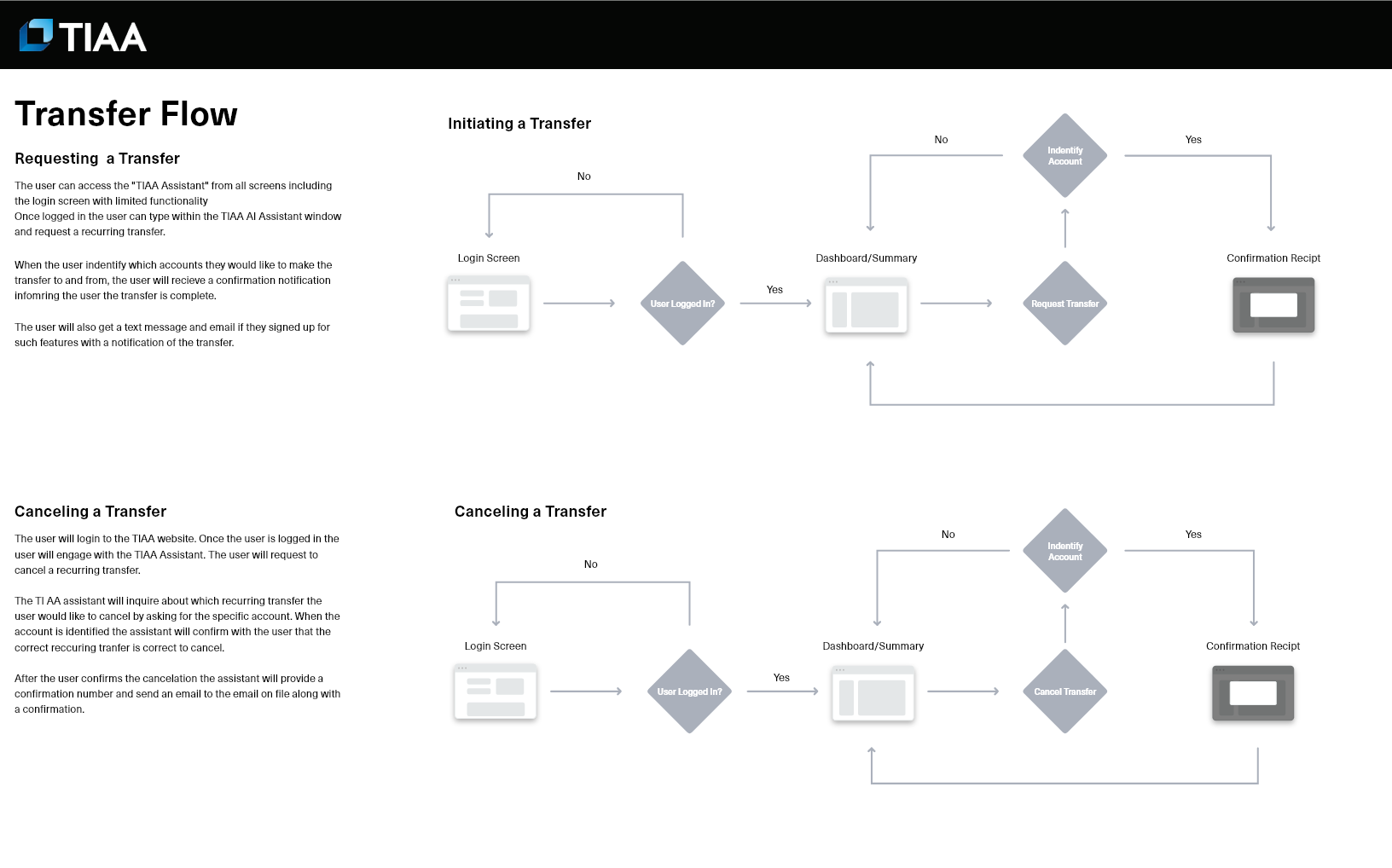

I led the end-to-end product design strategy:

To uncover key pain points and opportunities

With insights in hand, I:

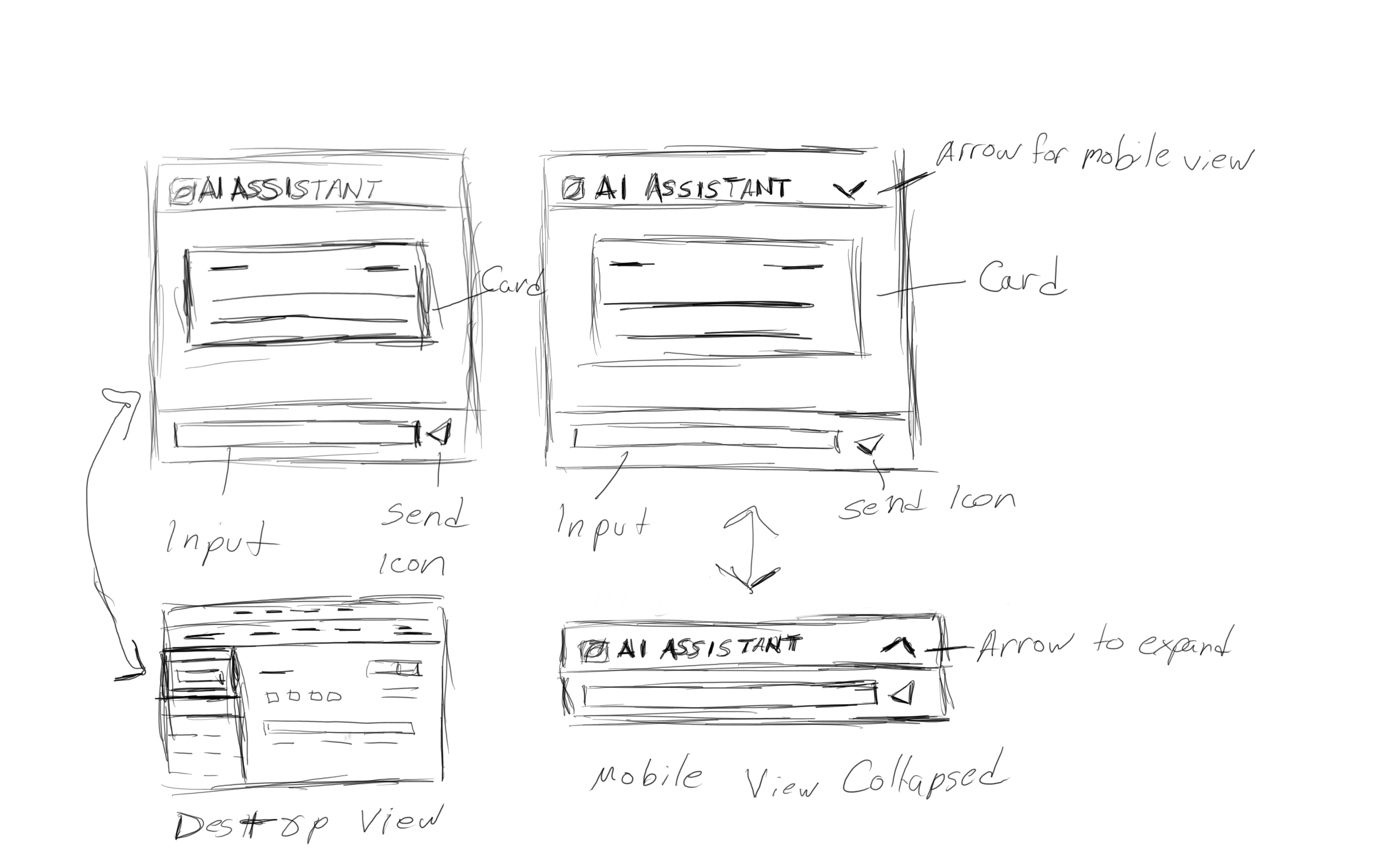

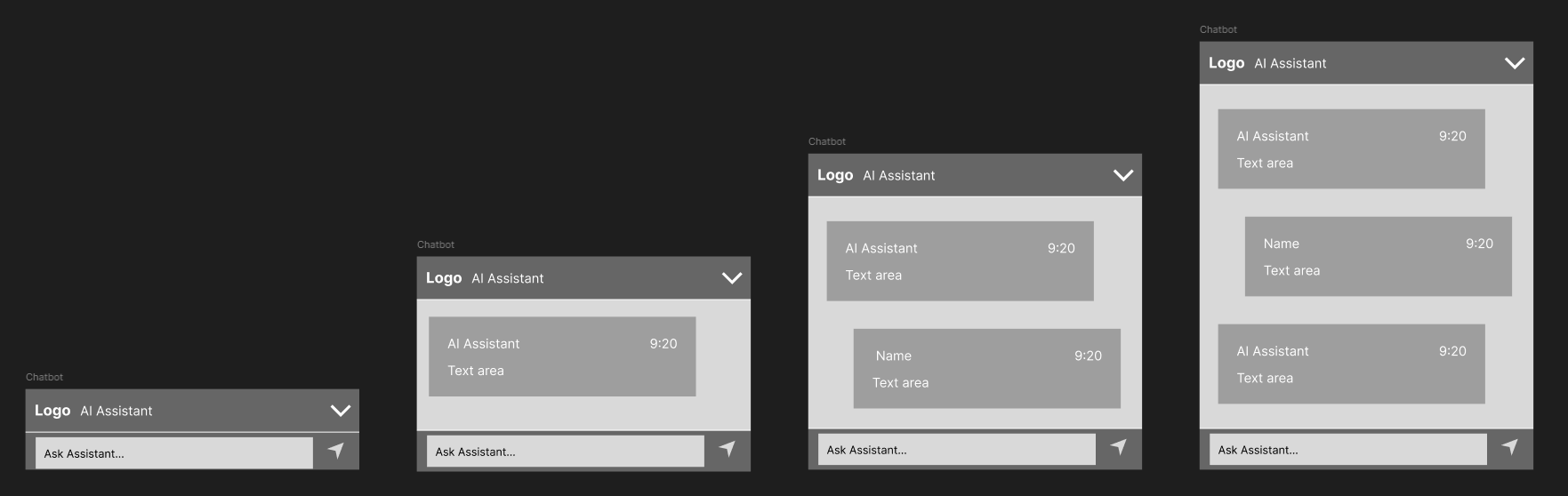

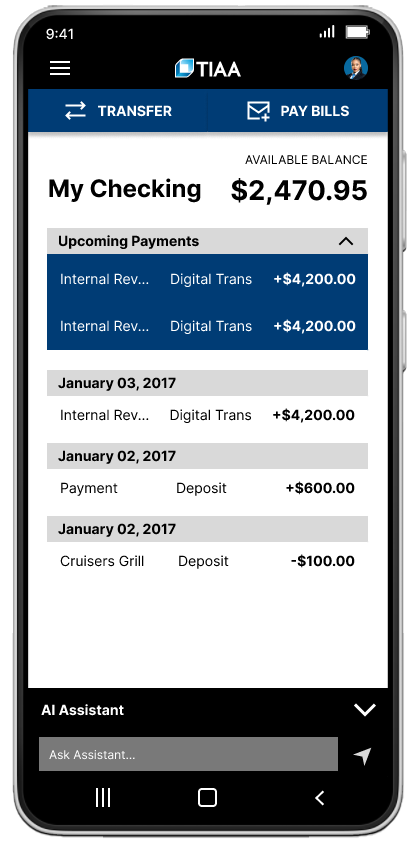

After completing the user research, I started sketching a few design concepts. I labeled a few key elements on the page to ensure I captured all interactions and functions.

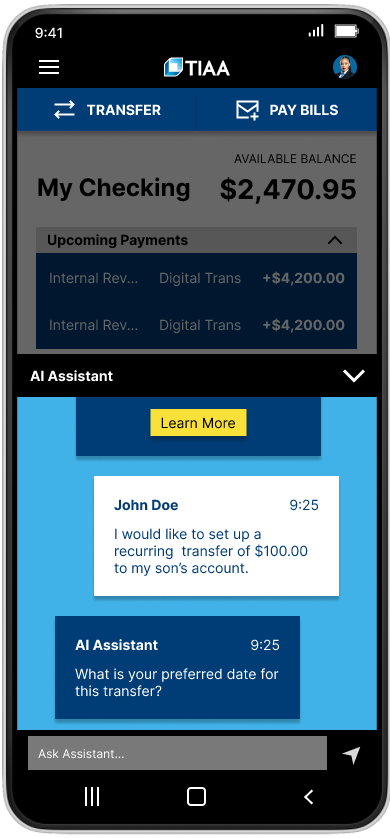

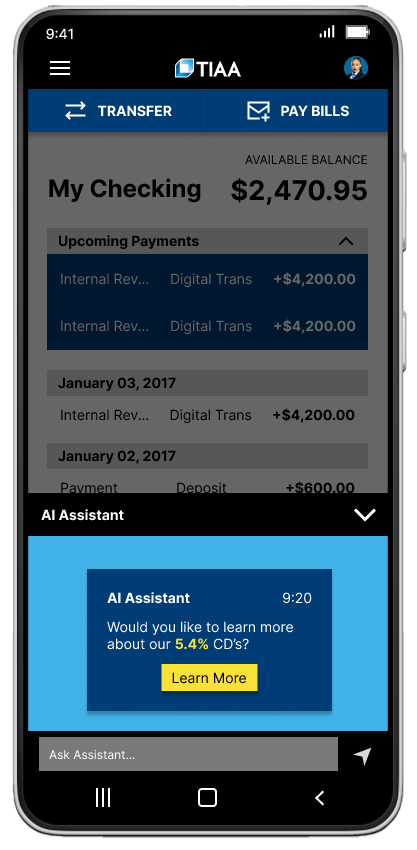

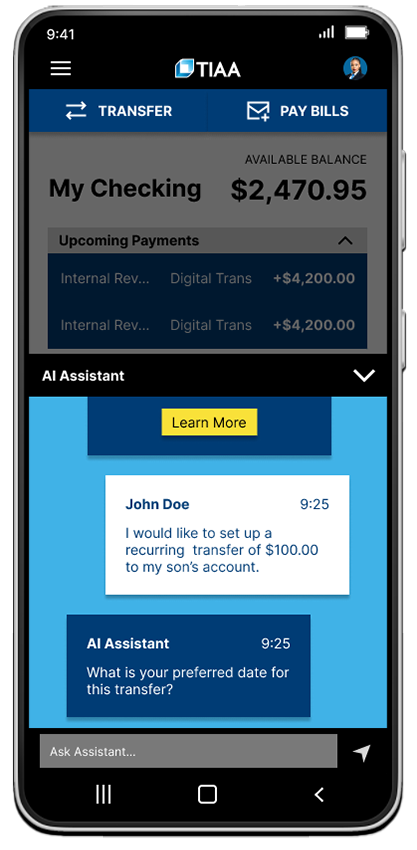

When designing the chatbot, I kept the user in mind, aiming for it to be an option that enhances the user experience without distracting from other features. The design was sketched with reusability as a focus, ensuring it's simple for both mobile and desktop, a decision that directly impacts our users' interactions.

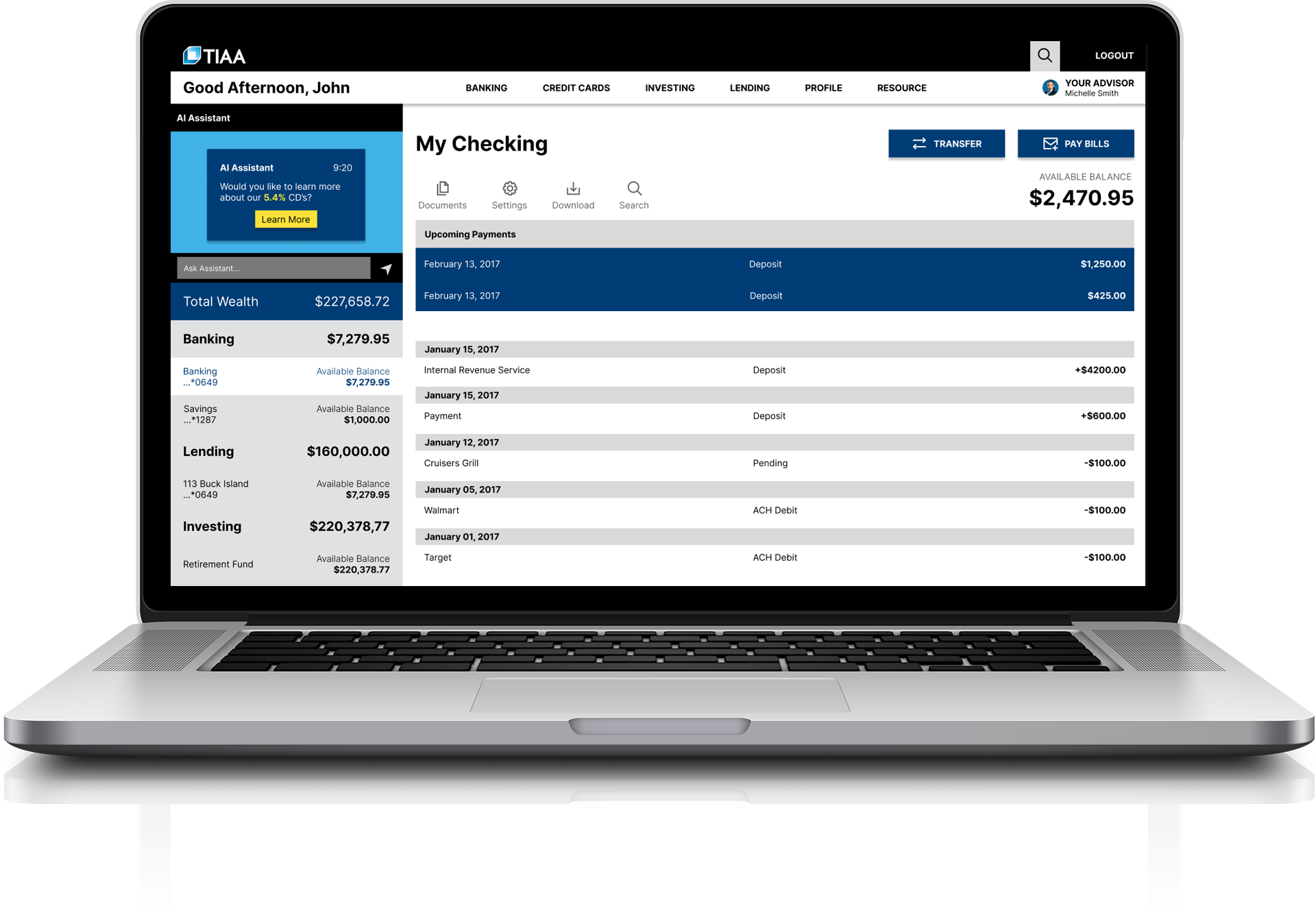

Once I had a firm grip on the concept based on the sketch, I started creating the initial wireframes, representing a low-fi user experience flow.

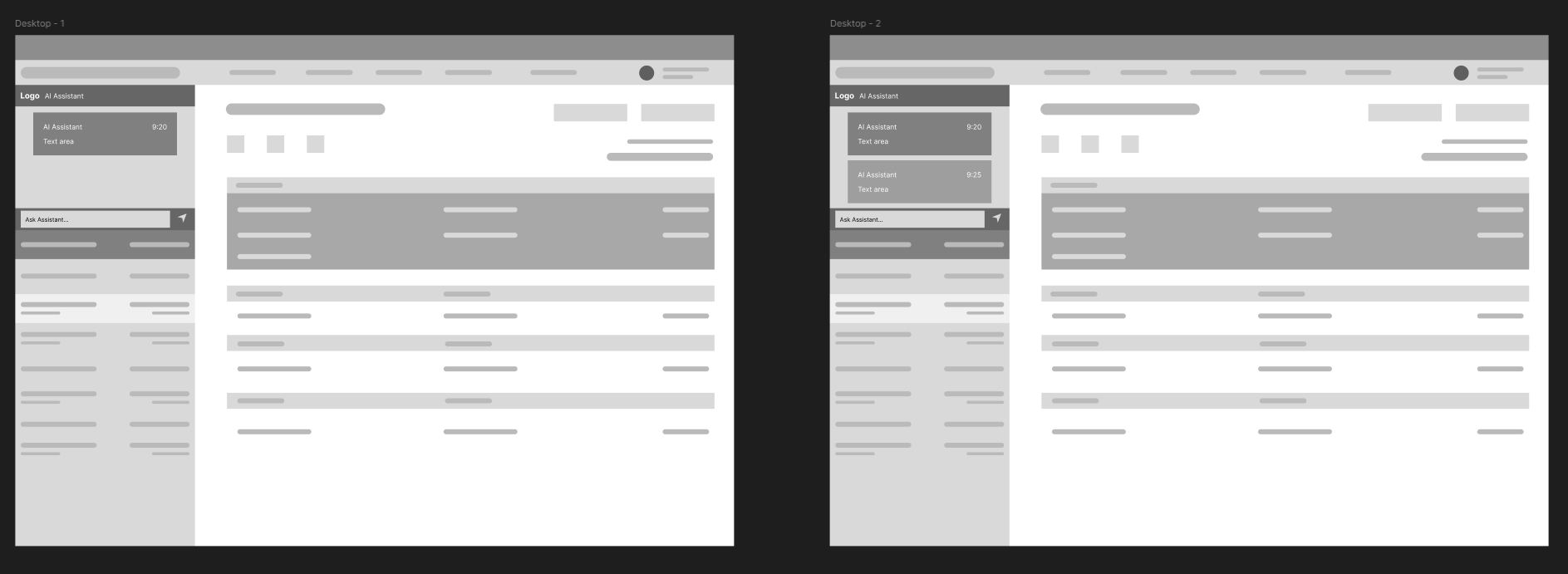

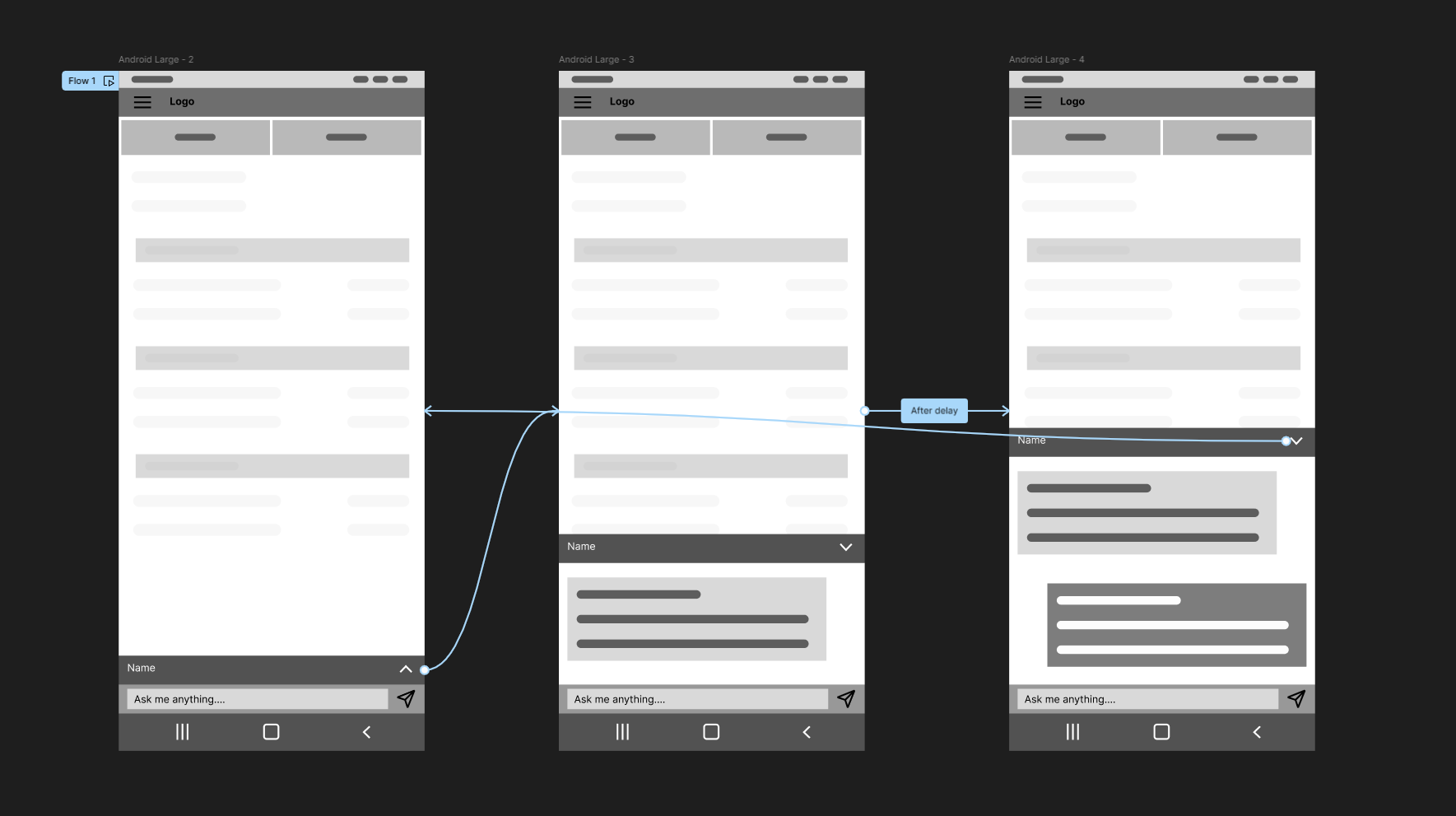

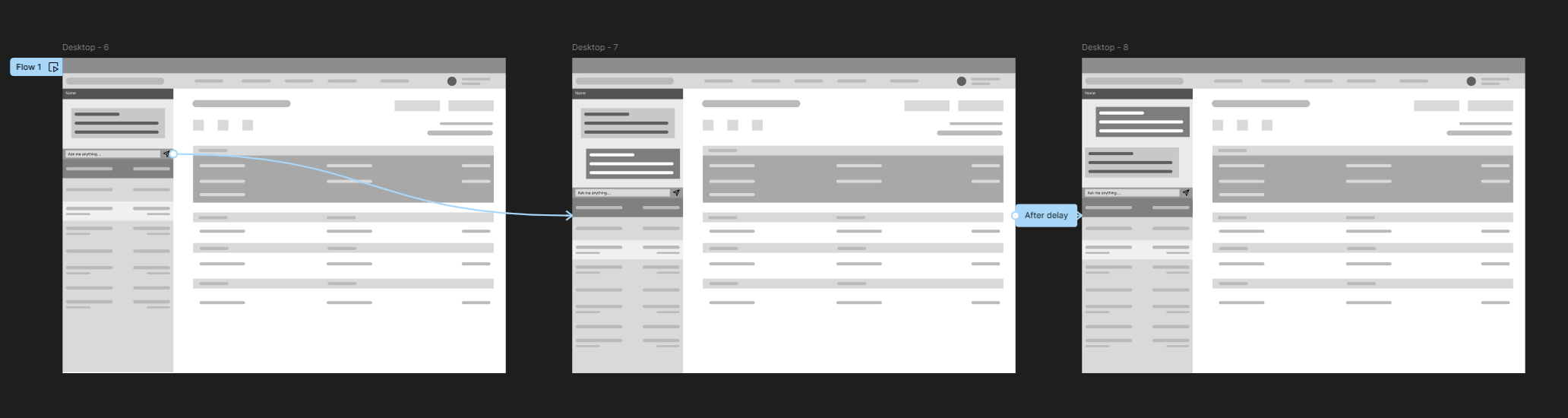

Adhering to the design process, I created interactive prototypes for mobile and desktop to ensure the application would function as expected.

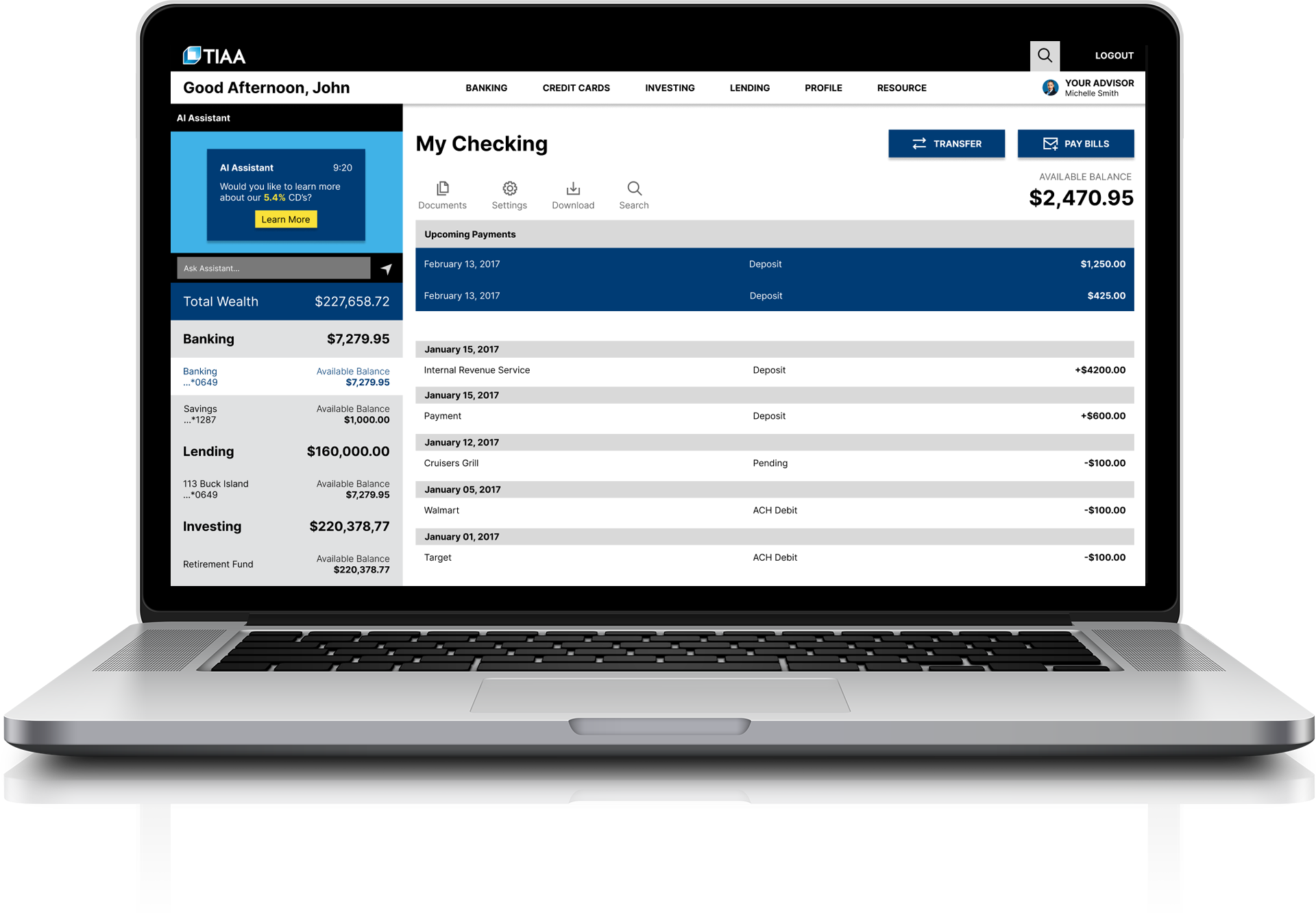

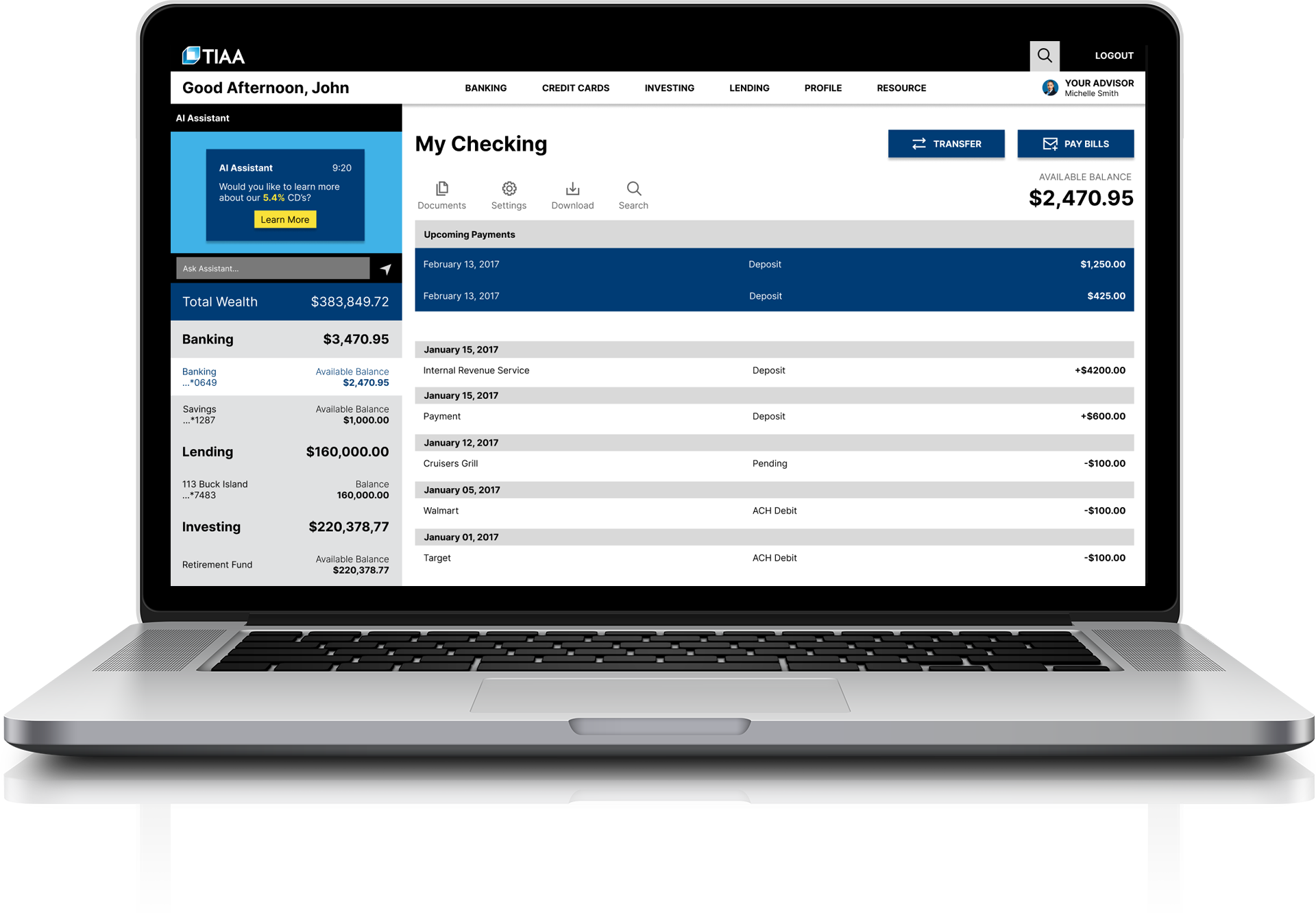

I designed a low-fi prototype of the desktop concept, and I wanted the content to expand the desktop version of the feature to emphasize the active chatbot.

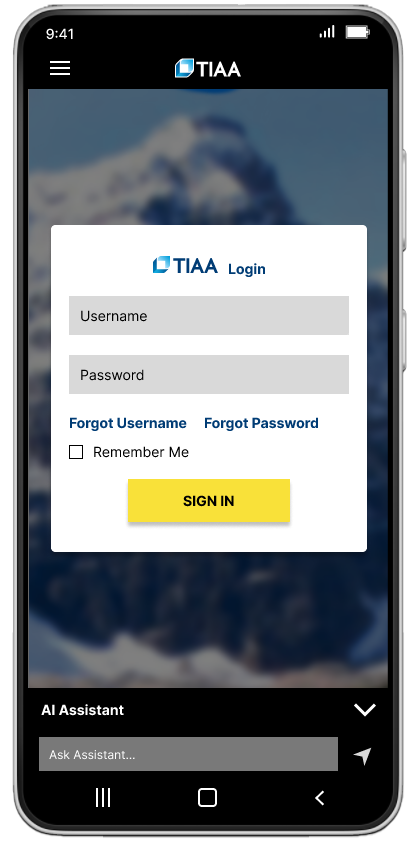

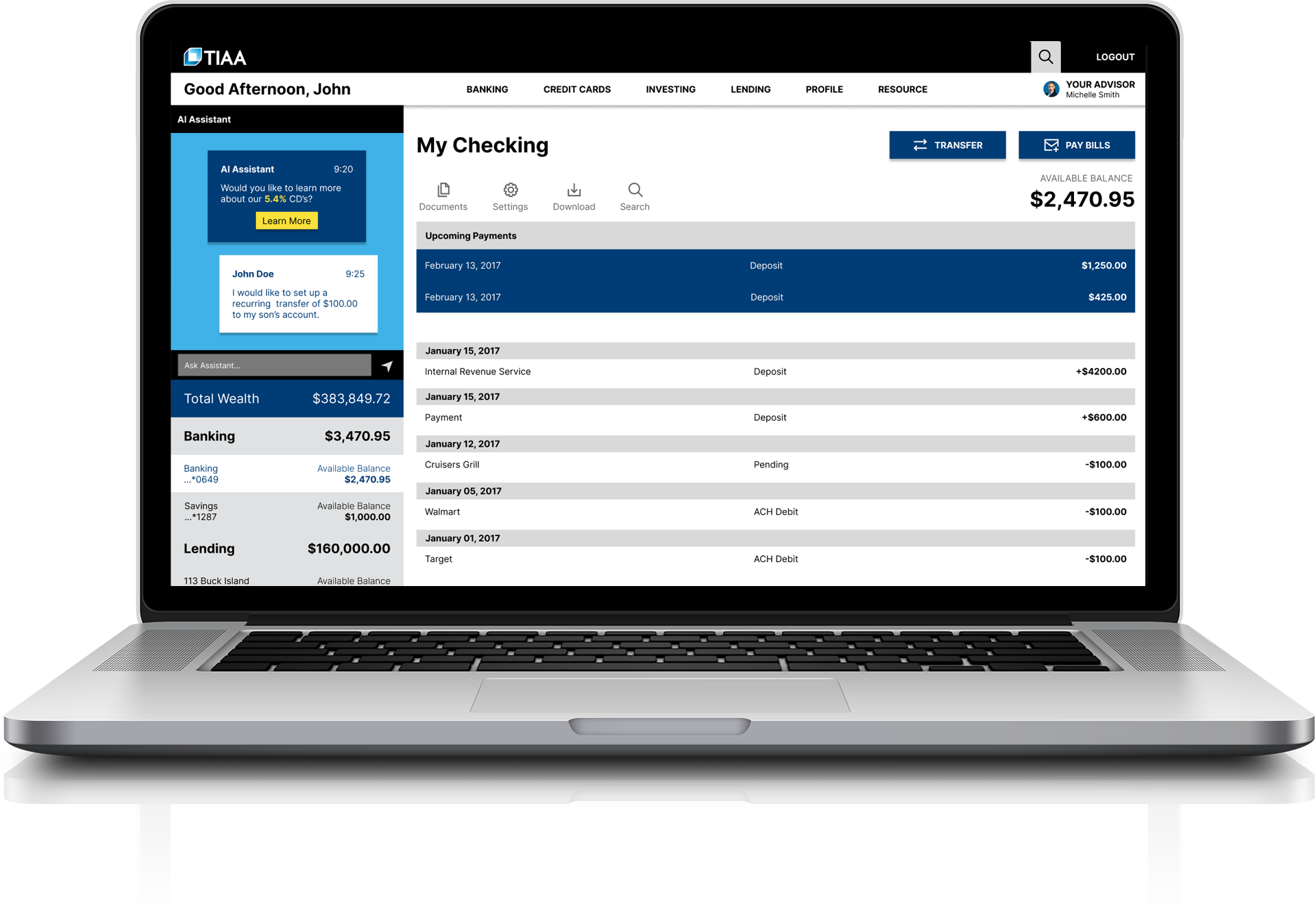

Following the usability study, a few participants stated that they had a hard time with background blending with the chatbot.

With the blending issue in mind, I decided to add an overlay over the distracting background content.

After conducting usability studies, I noticed a trend in which participants did not initially see the chatbot feature. I wanted to emphasize the chat feature, so I moved it from the bottom right of the screen to the top left.

Please click the button to see the high fidility prototype of the mobile experiecnce.

Please click the button to see the high fidility prototype of the desktop experience.

After launching the redesigned assistant as part of the TIAA app's R&D rollout: