EAGLE GROW

Mobile Application

Mobile Application

Principal Product Designer

First Republic Bank

Design a mobile banking applicaiton that is kid friendly

iOS, Android, and Web

Eagle Grow promotes financial literacy for children by allowing them to request money transfers from parents, assign and track chores for rewards, and manage their own budget. Parents can approve requests, set spending limits, and oversee all financial activities.

Children lack essential financial literacy skills and practical money management experience. Traditional education systems often overlook these critical skills. Parents face challenges in teaching financial concepts effectively. This gap leads to poor financial decisions in adulthood.

Without practical tools, children struggle to understand the value of money and budgeting. The absence of structured systems for requesting and managing funds from parents hampers their ability to plan and justify financial needs. This deficiency can lead to irresponsible financial behavior and poor decision-making.

The goal of the transfer process in the application is to teach children financial responsibility and planning by allowing them to request money from their parents. This process encourages children to think critically about their financial needs, justify their expenses, and manage their budget effectively. Parents provide oversight by approving or denying requests, ensuring a safe learning environment and fostering constructive financial habits.

I was responsible for conducting research, competitive analysis, creating user flows, low-fidelity / high-fidelity wireframes, prototypes, and conducting user testing.

While conceptualizing this application, I thoroughly examined several banks' children's debit accounts. Many major banks lacked simplified solutions that effectively combined financial education with practical usage for children. Specifically, the research revealed critical pain points in the transfer process, such as the lack of a structured system for children to request and justify transfers, and insufficient parental oversight features. These insights highlighted the need for a more integrated and educational approach to children's financial services, particularly in facilitating a seamless and educational transfer request process.

The new transfer feature enhances financial literacy by teaching budgeting and planning, offers practical financial management experience, ensures parental control and supervision, promotes responsibility and accountability, and motivates goal-oriented saving.

Children often lack understanding of financial planning and justification when requesting transfers, leading to potential misuse of funds and missed learning opportunities about budgeting and responsible spending.

The goal is to empower children with the ability to understand and justify their financial needs when requesting transfers, fostering responsible money management habits and enhancing overall financial literacy from a young age.

Children often struggle with articulating and justifying their financial needs when requesting transfers, hindering their ability to learn effective budgeting and financial responsibility.

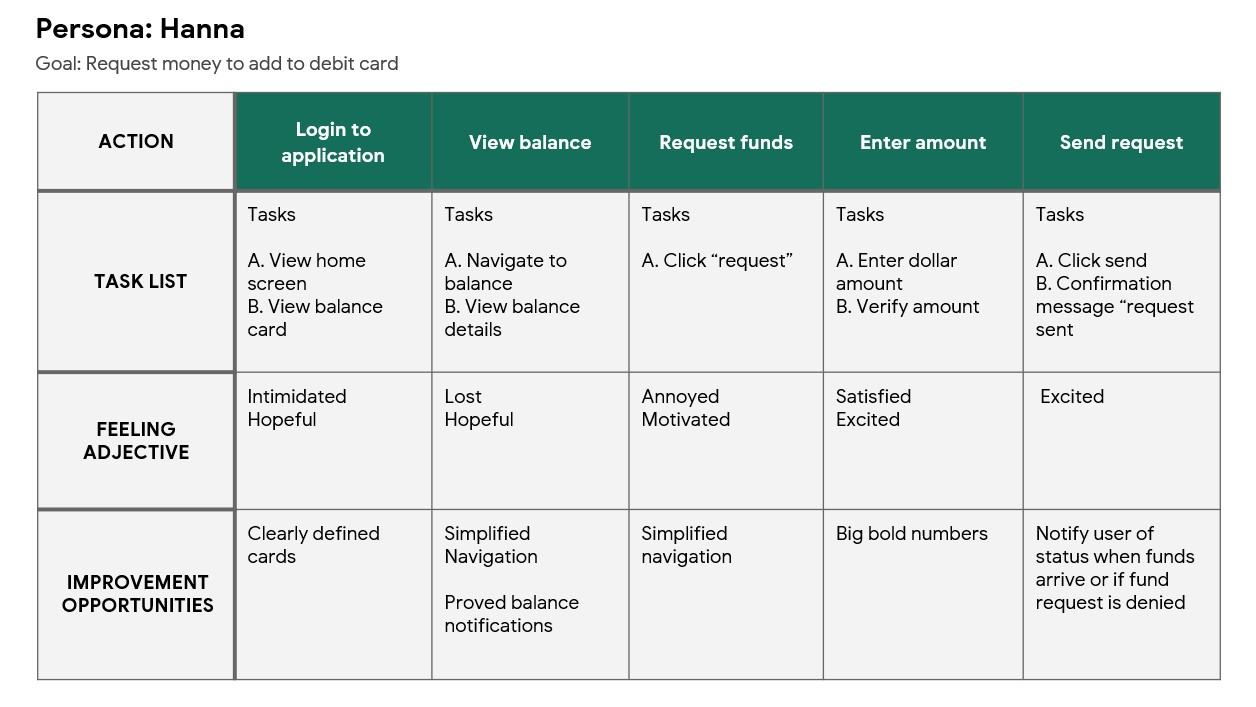

Hanna is a 10-year-old 5th grader who needs an app that makes it simple and fun to request money from her parents for online purchases, like buying video games. She wants an easy way to manage her money and track her savings so she can quickly and confidently make decisions when she finds something she wants to buy.

"I want to save up for something cool, but I need to ask my parents for money, and I wish it was easier!"

Earning Money: Hanna wants to earn her own money by doing chores so she can save up for things she likes, such as toys or games.

Learning Responsibility: She’s eager to learn how to manage her money and make decisions about what to spend it on.

Easy Money Requests: Hanna wants a simple way to ask her parents for money, especially when she sees something she wants to buy online or in a store.

Saving for a Goal: Hanna is excited to save money for specific goals, like a new game or a special outing with friends.

Complex Process: Hanna finds it frustrating when she has to ask for money in person or wait for her parents to be available, which sometimes makes her feel embarrassed or impatient.

Limited Control: She feels limited by not being able to track how much money she has earned from chores or how close she is to her savings goal.

Spending Restrictions: Hanna doesn’t fully understand why some purchases are restricted by her parents, which can lead to frustration and confusion.

Chore Management: Hanna sometimes forgets which chores she’s supposed to do, and she wishes there was an easier way to keep track.

Hanna is a curious and eager learner who loves to explore new things and ask questions, especially when it comes to understanding how money works. She is determined and goal-oriented, often setting her mind on specific targets, whether it’s saving for a toy or completing her chores. Hanna’s creativity and imagination shine through in her playtime and in how she thinks about earning and managing money. She is social and friendly, enjoying time with her friends and family, and often seeks their approval and advice on her ideas. Despite her young age, Hanna takes pride in being responsible and independent, striving to manage her own money and make decisions on her own.

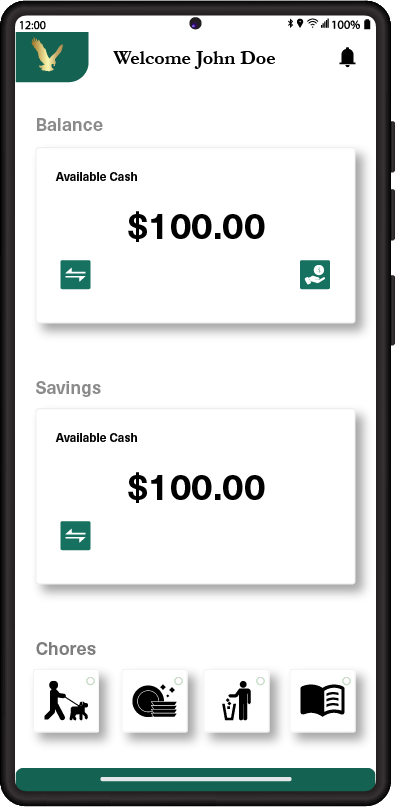

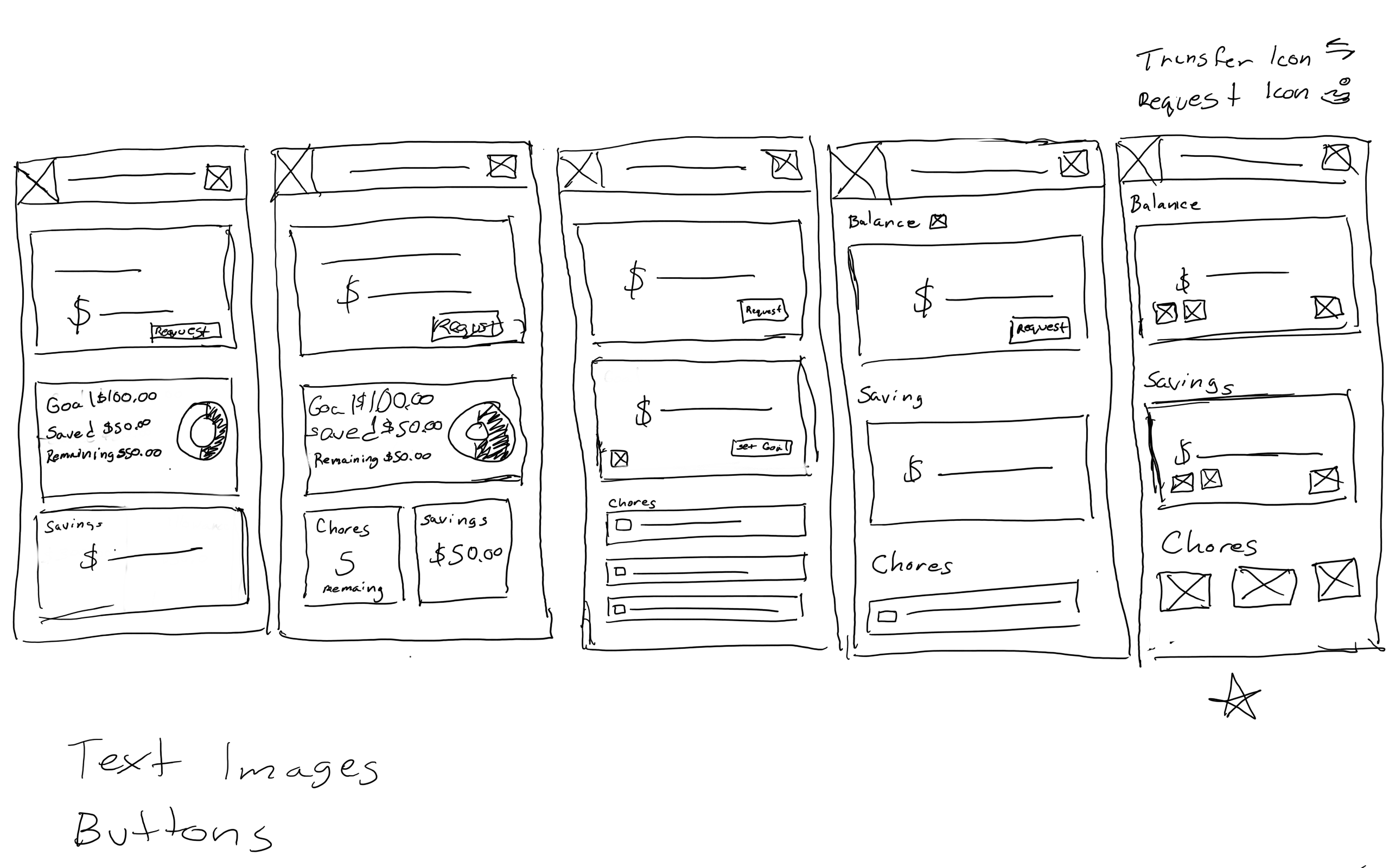

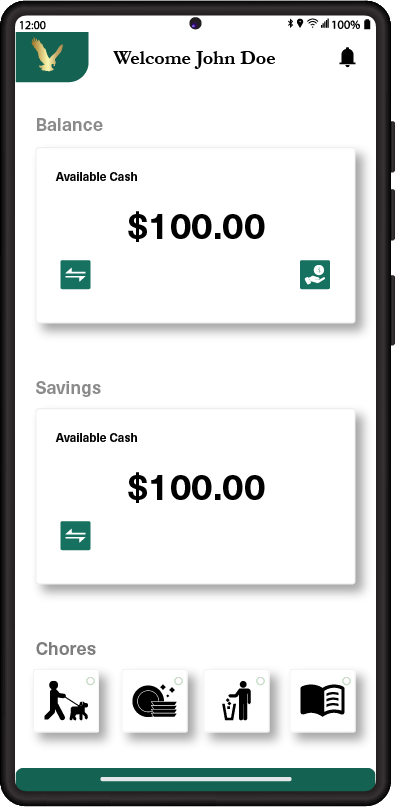

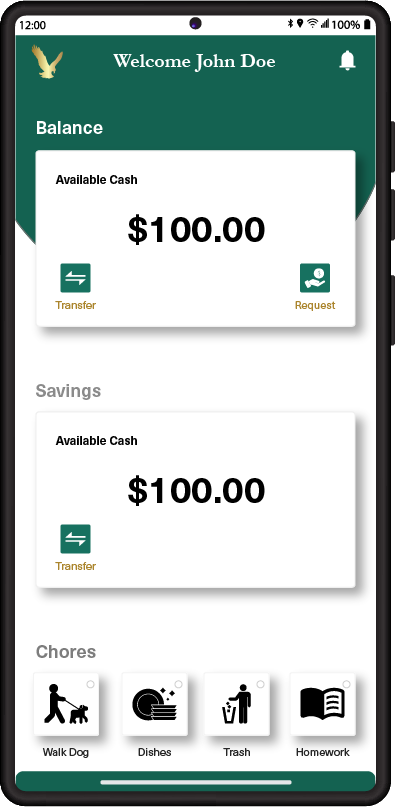

In this wireframe, I developed five landing page options. Considering the app's child-friendly design, I opted for the final wireframe. This design emphasizes icons and symbols over text, catering to our young audience. I wanted the design to be simple and aesthetically pleasant.

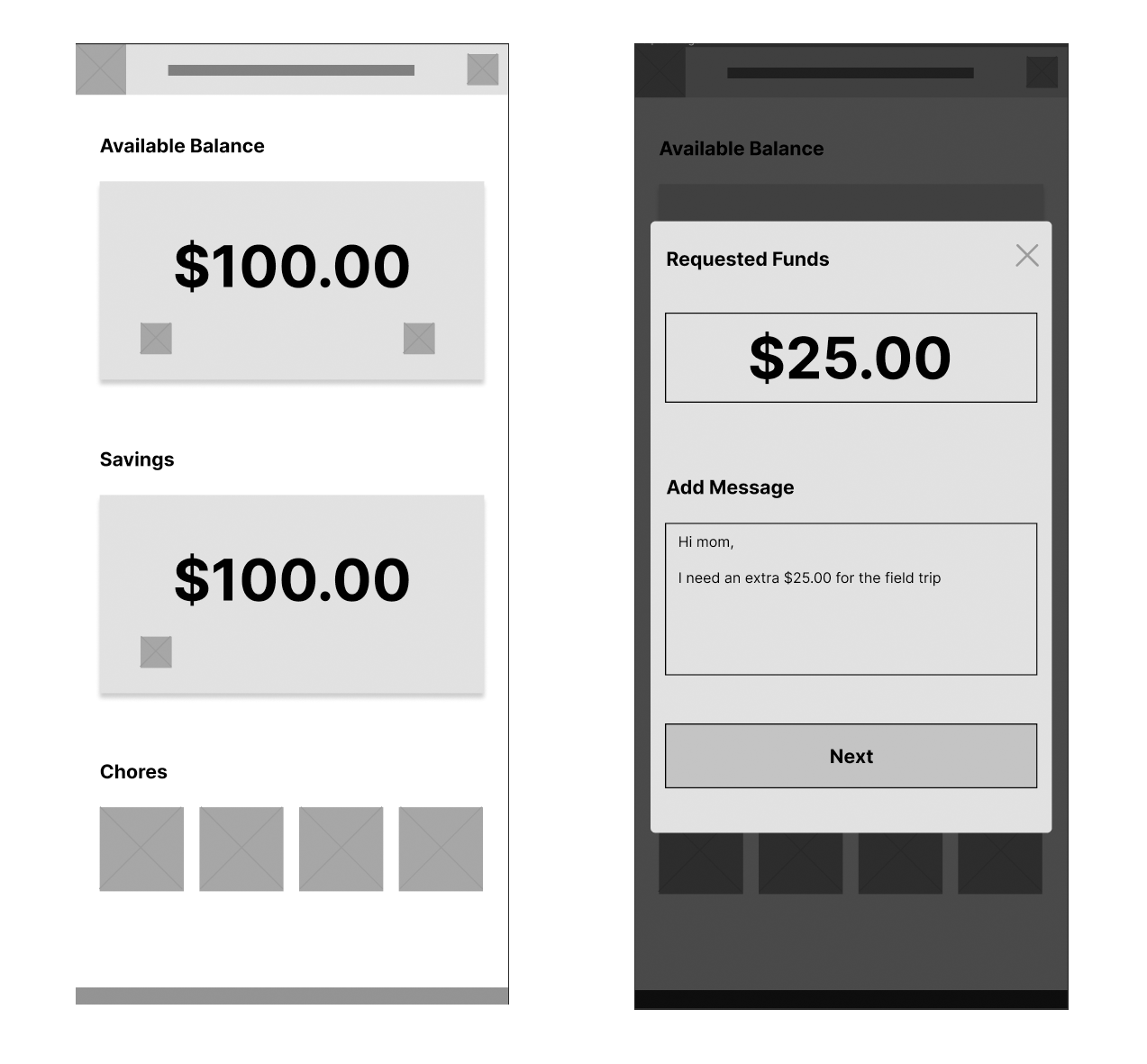

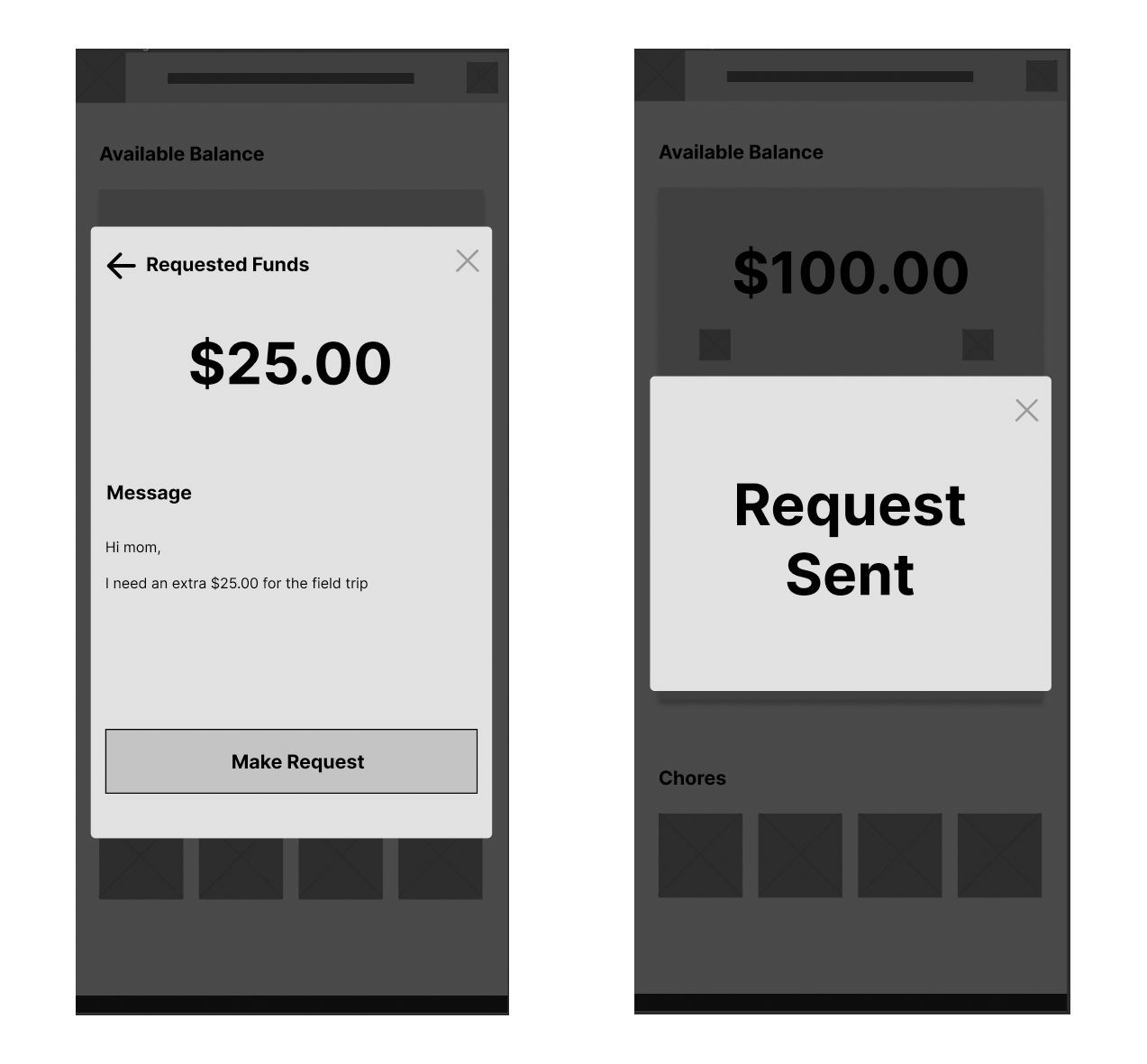

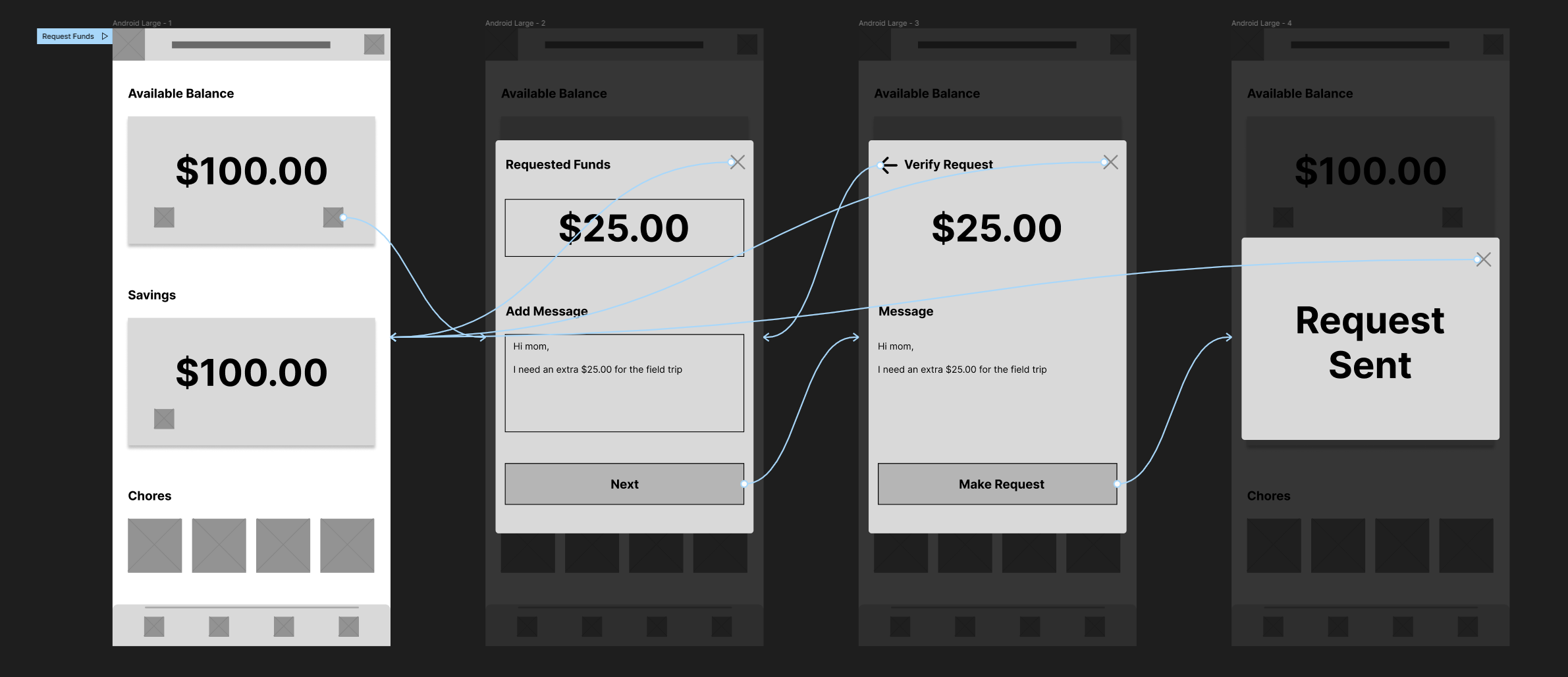

The wireframes for the children's transfer app feature a simple and intuitive layout designed to be easily navigable for young users. This simplicity reassures the users and instills confidence in their ability to use the app. Each screen emphasizes visual elements such as large, colorful icons and minimal text to aid comprehension.

These wireframes ensure that the app provides a straightforward and engaging user experience tailored to children, fostering financial literacy and responsibility in a playful yet educational manner.

Once I completed the overall layout, I created a low-fidelity prototype, which included the transfer request feature.

During the usability study, a few users struggled to understand what the icons meant. Following the usability study, I felt the best approach to resolve this challenge was to add text under the icons indicating what each button does.

You can view a live demo of the transfer process by clicking the view prototype button.

Through Eaglegrow's fund transfer feature, families experienced a 50% reduction in the time required to send and receive money between parents and children. Usability testing revealed that 8 out of 10 users found the fund transfer process intuitive and efficient. Additionally, 90% of parents reported increased convenience in managing allowances and rewards, showcasing Eaglegrow's effectiveness in streamlining financial transactions within the family unit.

I learned that the app's fund transfer feature significantly improves the efficiency of financial transactions within families, with a notable reduction in time required for sending and receiving money. Users found the transfer process intuitive and efficient, leading to increased convenience in managing allowances and rewards. This feedback underscores the importance of seamless fund transfer functionality in enhancing the overall user experience of Eaglegrow.

Enhanced Security Features: Implementing additional security measures such as biometric authentication or two-factor authentication to further safeguard financial transactions and sensitive information within the Eaglegrow application.

Developing more interactive and engaging financial literacy resources within the app, including videos, games, and quizzes, to deepen children's understanding of financial concepts and promote continuous learning.

Partnering with schools or educational institutions to integrate Eaglegrow into financial literacy curriculums, allowing teachers to track students' progress and reinforce financial lessons both in and out of the classroom.